How To Declare Mutual Fund Investment In Itr

How To Declare Mutual Fund Investment In Itr. You can get the capital gain statement for all your investment in mutual funds (including ones not done through etmoney) on the etmoney app, instantly, in just one tap. Investment into these schemes allows you a deduction from your taxable income to the tune of rs.

You will need to declare the dividends received by. Investment into these schemes allows you a deduction from your taxable income to the tune of rs. A) taxation of dividend income from equity mutual funds

The Total Deduction Limit Allowed U/S 80C Is Inr 1.5 Lakh For A Financial Year.

Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. Mutual funds gains you need to show in itr. Let’s look at how tax.

How To Declare Mutual Fund Investments In Itr And Disclose Capital Gains.

Here is how you must complete the procedure to report your income from mutual fund investments. You will need to declare the dividends received by. These assets are equities, preference shares, securities, units, equity oriented mutual funds and zero coupon bonds.

Investment Into These Schemes Allows You A Deduction From Your Taxable Income To The Tune Of Rs.

1.5 lakh under section 80c of the income tax act, 1961, that you may declare under the heading ‘chapter vi a deductions’ in your itr. Choose the relevant itr form for you. A) taxation of dividend income from equity mutual funds

You Can Show Your Mutual Fund's Investment In Itr 1, And Claim Deductions U/S 80C.

How to declare mutual fund investments in itr. Amit gupta, md, sag infotech, shares his knowledge on how stock market gains are taxed and how to declare them in your itr filing. Declaring your investment returns while filing your income tax returns is not as straightforward as it may seem.

Click Here To Know How Mutual Funds Are Taxed And Find Out How To Declare Mutual Funds While Filing Itr!

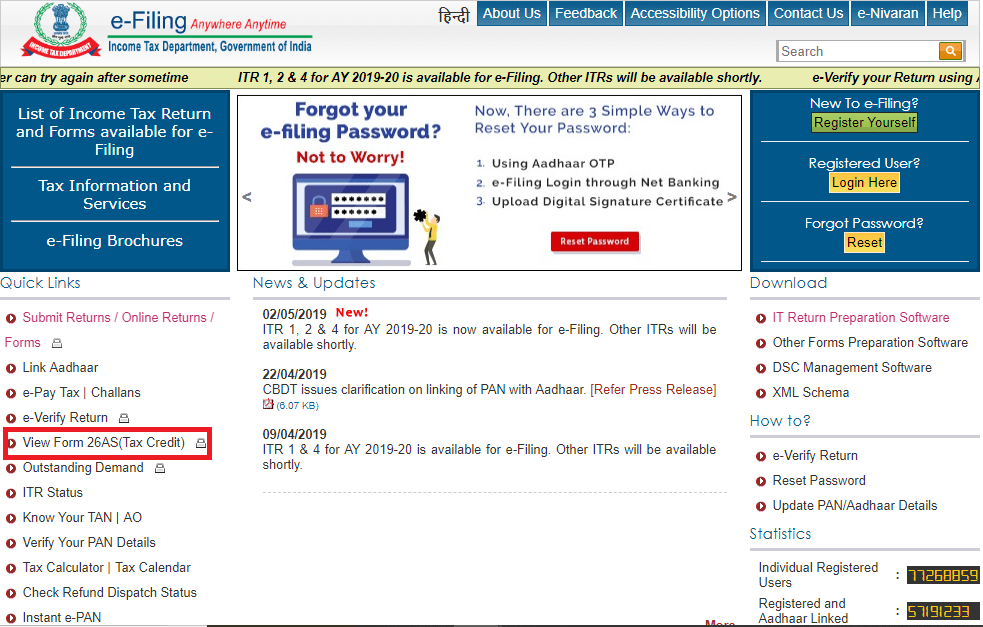

You will have to download the income tax xml for itr 2 from the income tax department’s website, fill it, and submit a return by. At the time of investing when you invest money in mutual funds, it does not immediately affect your taxes. You can declare the investment at the beginning of a financial year itself or you can declare it at the end of the financial year.

Post a Comment for "How To Declare Mutual Fund Investment In Itr"