Does Inflation Affect Investment

Does Inflation Affect Investment. To help understand inflation’s impact on purchasing power, consider the following illustration of the effects of inflation over time. Inflation can have a significant impact on your portfolio over time.

In fact, these companies most likely do not increase their dividends on a par with inflationary growth, which will lead investors to give up. How does inflation affect your tax planning? Inflation is the rate at which the prices of goods and services increase, resulting in the decreased purchasing power of money.

Diversifying Your Portfolio With Exposure To U.s.

Therefore, keeping pace with inflation is a crucial goal for many investors. We’ve had an unusually long period of stable, low inflation 1, which means we’ve had the luxury of not having to think about it. Investments must consider inflation when determining.

Stocks And Real Assets Such As Commodities May Help You Shield Your Money Against Inflation.

A reit is an investment trust in real estate. But in june 2021, the office for national statistics reported a 2.4% rise, which is above the 2% target set by the bank of england. A balanced strategy consisting of 60/40 stock and bonds.

If The Business Requires A Lot Of Capital To Grow, Like A Factory Expanding Or You Increasing The Number Of Rental Properties, Inflation Increases The Cost Of Such Growth.

Let us understand this in a little more detail by comprehending the different aspects of financial planning. This list includes the s&p 500, which represents 100 of the biggest companies in the united states. During times of high inflation, a company might seem to be doing well as revenue and earnings increase with the rate of inflation.

We All Know That When Inflation Rises, The Value Of The Dollar Decreases, And This Means That You Will Spend More On The Products You Could Buy At $50 Before.

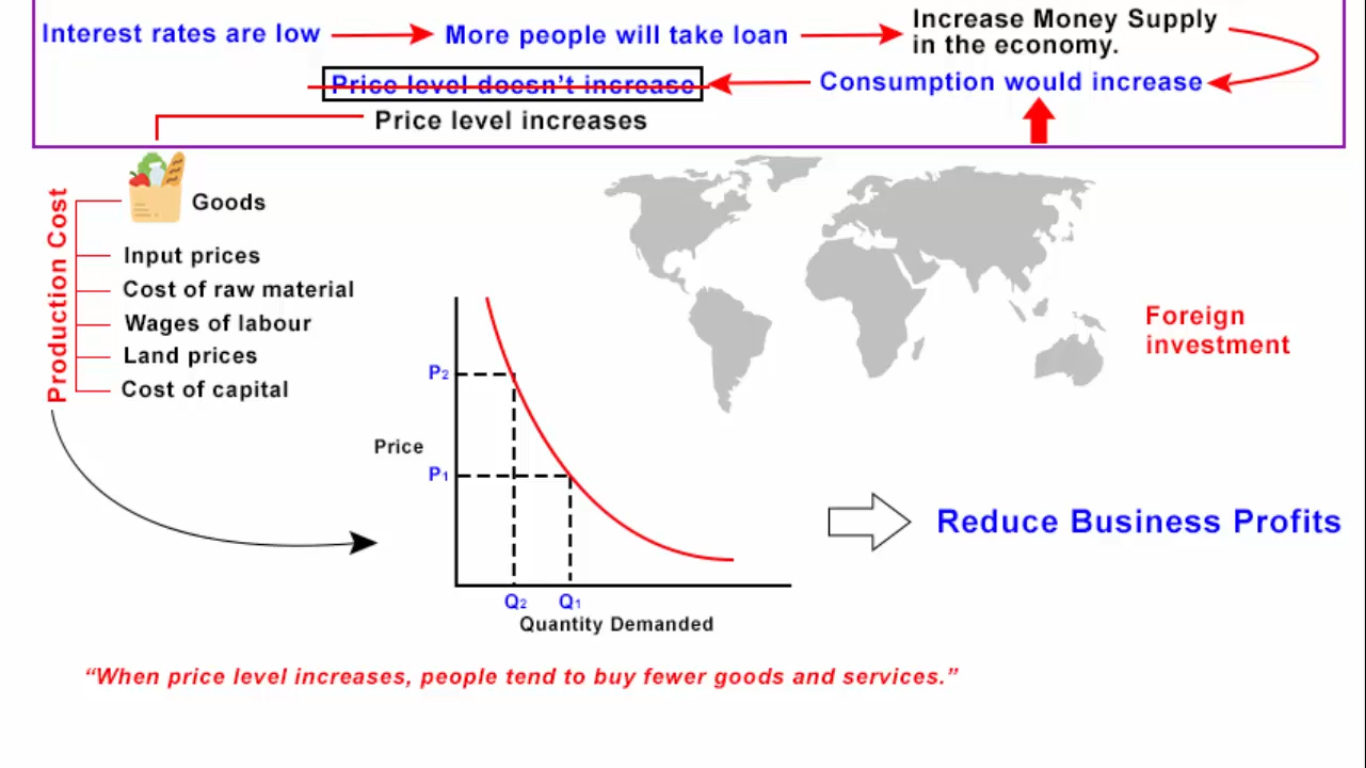

Effect of inflation on interest rates. In recent years, many successful investment strategies have been based around the assumption of continued low and stable inflation. Inflation can have a significant impact on your portfolio over time.

Inflation Is The Rate At Which The Prices Of Goods And Services Increase, Resulting In The Decreased Purchasing Power Of Money.

How does inflation affect your tax planning? A four percent inflation annually rate would erode the value of a dollar down to $0.44 in just 20 years. In this article, we look at how rising inflation could affect the economy and investment markets.

Post a Comment for "Does Inflation Affect Investment"