How Do You Diversify Your Portfolio By Age

How Do You Diversify Your Portfolio By Age. That is to say, rather than investing in a small number of stocks or etfs , you should broaden your horizons as best as possible. That way, if one type of fund isn’t doing well, the other three can balance it out.

So, once you've decided on the assets you want in your portfolio, you can diversify further by investing in different sectors and industries, preferably those that aren’t highly correlated to each other. The 70% percentage is conservative and can go higher to 80% allocated to stocks. One way to balance risk and reward in your investment portfolio is to diversify your assets.

One Of The Least Utilised Ways To Diversify A Portfolio Is Geographically.

“100/0” or “60/40” is called your asset allocation, which is highly personal and is determined by your time horizon. At a minimum, you should plan to rebalance at least once each year, so you can reset your portfolio to your desired asset allocation. A 60/40 fund, for instance, will maintain a.

The Result Is The Percentage Of Your Portfolio That Should Be In Stocks.

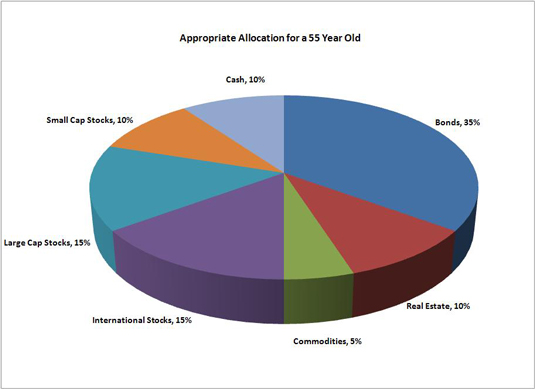

You can consider the investment as per age, e.g., you can take some risk to derive profits, but if you don’t want, then you can think about investing 70% in stocks and 30% in bonds out of 100% in the portfolio. That’s because the closer you get to retirement age, the less time you have to bounce back from stock dips. If you have not tried planning your asset allocation before, an easy way to start would be to follow the typical '100 minus age' rule where you subtract your age from 100 and put the resulting percentage in equities which are riskier, and the rest in bonds or any investments that are perceived to be low risk.

Conversely, If You Invest Too Aggressively When You're Older, You Could Leave Your Savings Exposed To Market Volatility, Which Could Erode The Value Of Your Assets At An Age When You Have Fewer Opportunities To Recoup Your Losses.

For instance, you can split your investments into two portions, one for stocks and the other for bonds. The reasons for having a diversified investment are: For example, when you’re 45, you should keep 65% of your portfolio in stocks.

Invest 10% To 25% Of The Stock Portion Of Your Portfolio In International Securities.

Why do you need diversified investment? The third strategy is to diversify by investing across asset classes. So, once you've decided on the assets you want in your portfolio, you can diversify further by investing in different sectors and industries, preferably those that aren’t highly correlated to each other.

To Build A Diversified Portfolio, You Should Look For Investments—Stocks, Bonds, Cash, Or Others—Whose Returns Haven't Historically Moved In The Same Direction And To The Same Degree.

One way to balance risk and reward in your investment portfolio is to diversify your assets. This way, even if a portion of your portfolio is declining, the rest of your portfolio is more likely to be growing, or at least not declining as much. Additional diversification options invest in a mix of etfs and mutual funds.

Post a Comment for "How Do You Diversify Your Portfolio By Age"